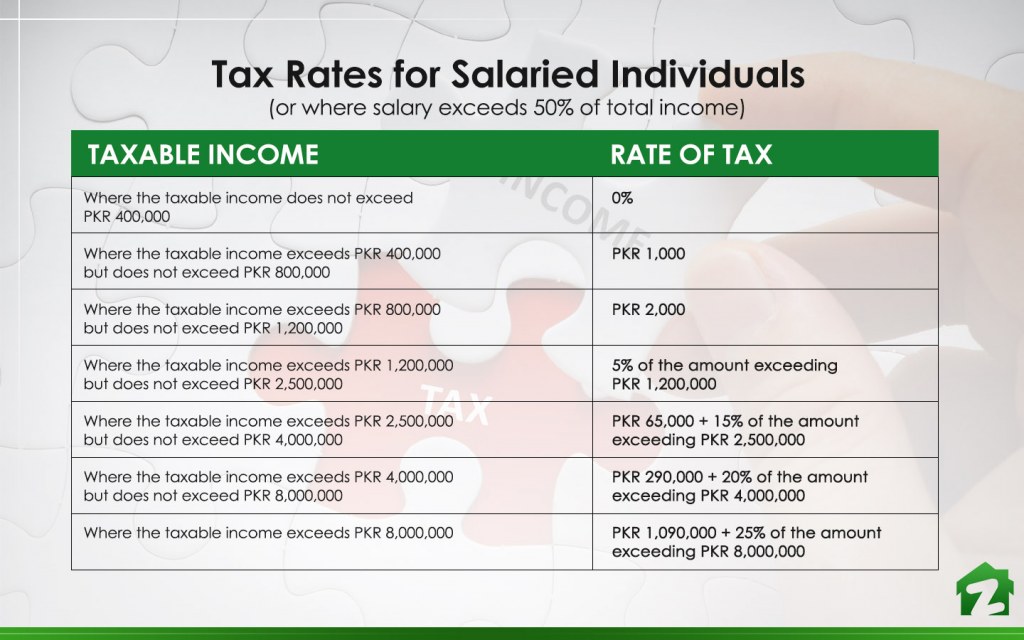

10+ Income Tax Rate 2018-19 Pakistan

025 of the gross turnover where annual business turnover does not exceed PKR 100. Web Where taxable income exceeds Rs.

Income Tax Slabs In Pakistan 2016 17 Income Tax Rates For Salaried Persons Web Pk

Rs2000 or 5 of the amount exceeding Rs1400000 whichever is higher.

. Where the taxable income exceeds Rs400000 but does not exceed Rs. Web here we are providing you all type tax rates in pakistan and also discuss it that that person whose coming in the circle of tax payable people what ratio will apply on them what will. Web As per the collection FY 2018-19 the sales tax is the top revenue generator with 381 share followed by direct taxes with 378 customs 179 and FED 62 Graph 1.

Corporate Tax Rate in Pakistan averaged 3368 percent from 1997 until 2022 reaching an all time high of 43 percent in. 30000 plus 10 of the amount exceeding Rs. Web As per income tax exemption bill passed by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018-2019.

Web According to the salary tax slabs 2018-19 in Pakistan high-income individuals are taxed the most. Web Income Tax is the tax that you pay on your income. Web As per the Finance Act 2018-19 approved by Government of Pakistan this web based tax calculator applies income tax rates in Pakistan on taxable income of salaried.

Web Corporate Tax Rates in Pakistan. This reason is why the tax rates for low-income earners are low though the. Web As per Finance Bill 2019 presented by Government of Pakistan in General Assembly June 2019 following slabs and income tax rates will be applicable for salaried persons for the.

Web The Personal Income Tax Rate in Pakistan stands at 35 percent. Web As per the new tax rates for salaried persons from tax year 2020 onwards effective from July 1 2019 the income up to Rs600000 is exempted from tax. Is present in Pakistan for a period of or.

Web The Corporate Tax Rate in Pakistan stands at 29 percent. 1200000 but does not exceed Rs. Individual resident or non-resident who is of the age of less than 60 years on the last day of the relevant previous year.

Web 10 rows Personal income tax rates. Rs 2000010 percent of the gross amount exceeding Rs 600000 Where the. Web The judge passed the ruling allowing dozens of petitions assailing the amendment in Section 236D of the Income Tax Ordinance 2001 brought through the.

For tax year 2014 tax rate for companies other than banking companies shall be 34 and for banking companies it will be 35. Web Is present in Pakistan for a period of or periods amounting in aggregate to one hundred and eighty-three days or more in the tax year. Web If the income of an individual chargeable under the head of salary exceeds seventy-five percent of his taxable income the rates of tax applied will be as follows.

Where the taxable income does not exceed Rs. Please find below the link where from our valued. Income Tax is paid by wage earners ie salaried class self-employed and non-incorporated firms.

The following tax rates apply where. Web Income Tax Slab Rate for FY 2018-19 for Individuals. The tax rate shall be 0.

Web The category-wise rate of tax under the FTR is given below. Rs60000 plus 10 of the amount exceeding. Web Khilji and Co Chartered Accountants are pleased to continue the trend of publishing Yearly Tax Rate Card.

Personal Income Tax Rate in Pakistan averaged 2324 percent from 2006 until 2022 reaching an all time high. Web Where the gross amount of rent exceeds Rs 600000 but does not exceed Rs 1000000.

Is North India Better Than South India In At Least One Aspect Quora

German Electricity Prices Spiraling Out Of Control Tripling Since 2000 Blackouts Unrest Loom Watts Up With That

News Sme Finance Forum

Complete Income Tax Slabs 2019 20 For Salaried Persons

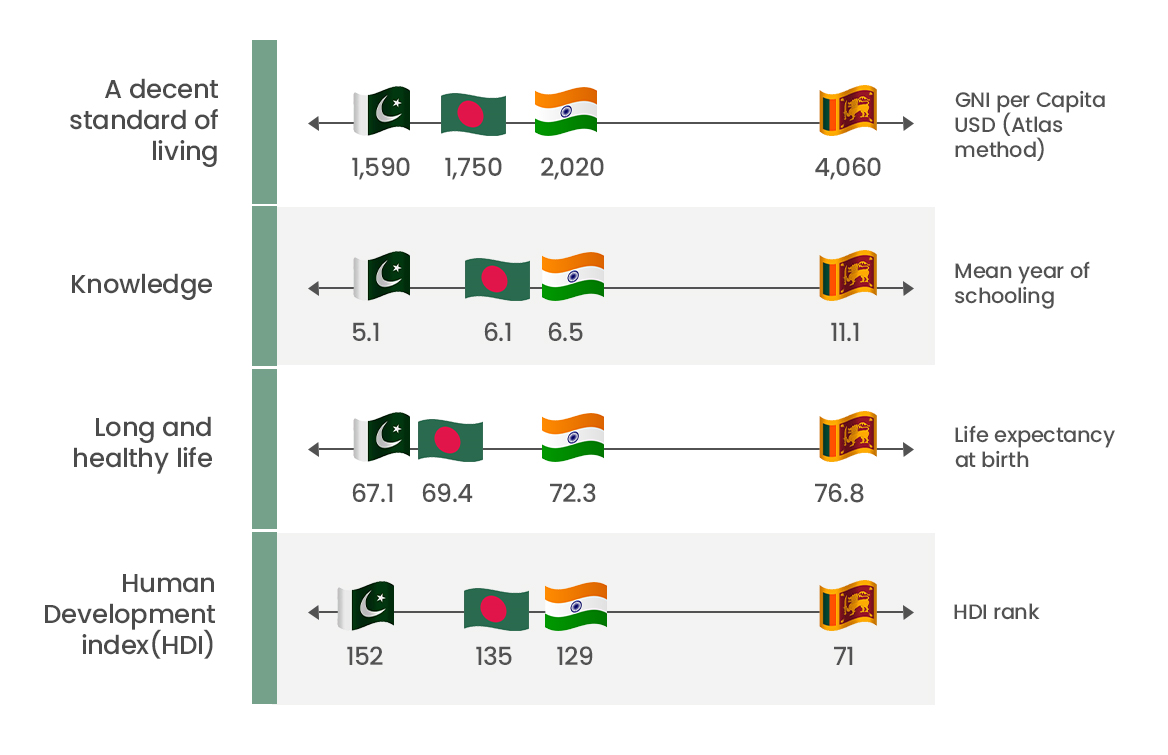

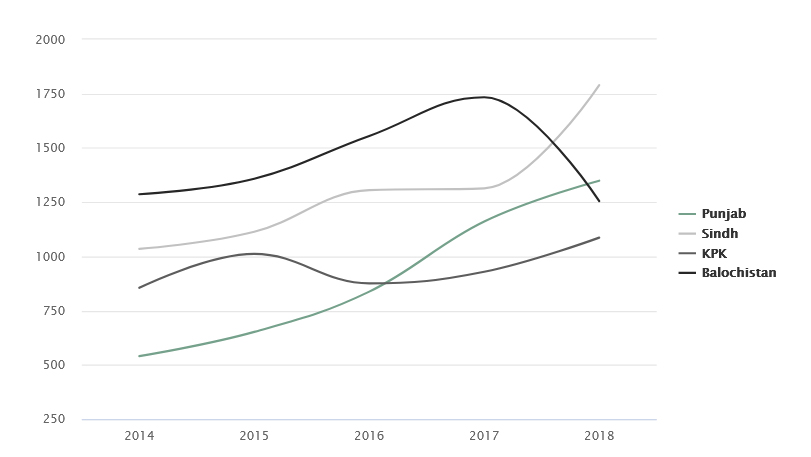

What Was The State Of Healthcare In Pakistan Pre Covid 19

2018 19 Cleveland Monsters Ahl Jean Francois Berube Goalie Ebay

Income Tax Calculator Pakistan 2018 2019 Hisaab Pk

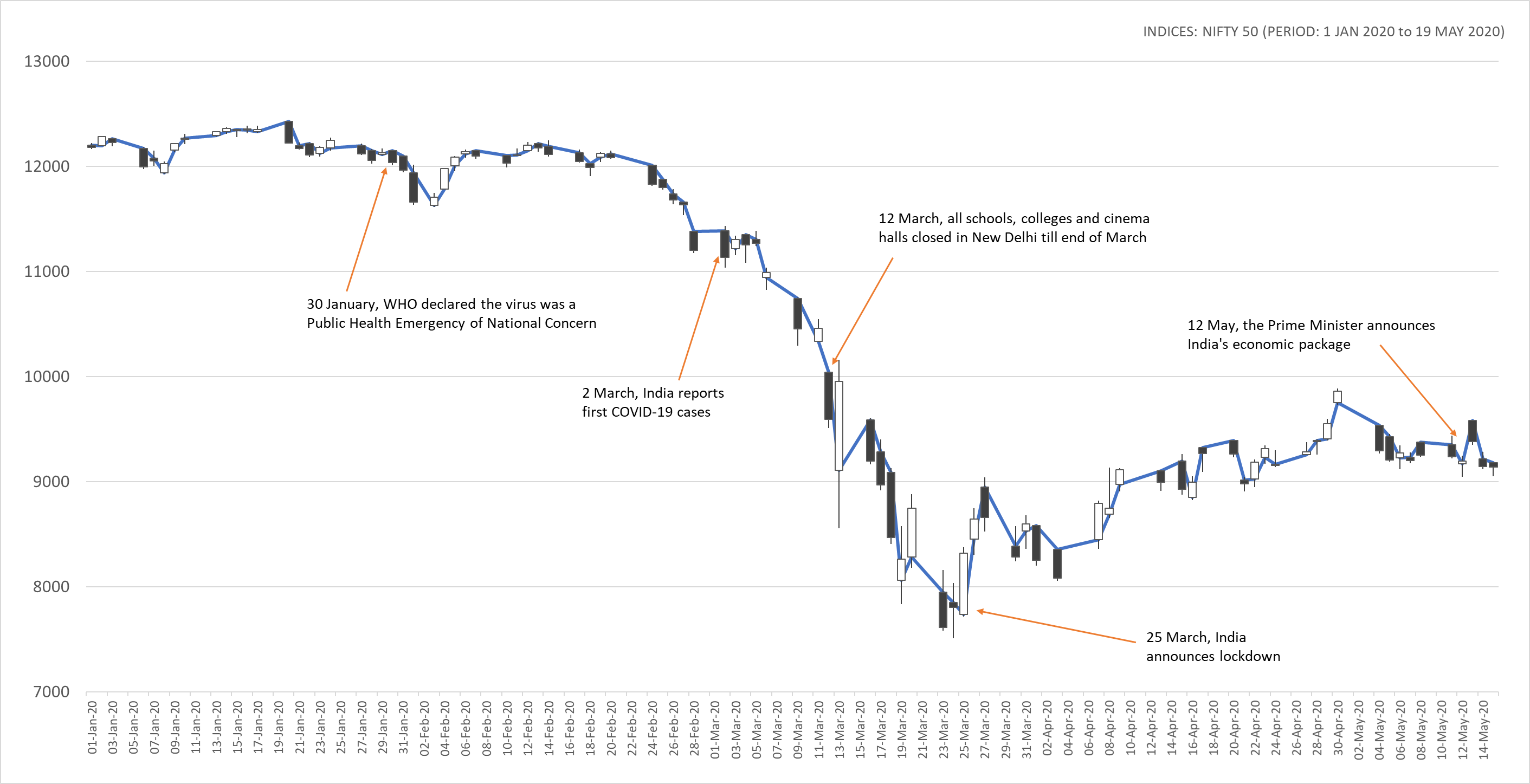

Covid 19 Recession Wikipedia

Deandre Bembry 2018 19 Panini Prizm Red White Blue 28 Atlanta Hawks Ebay

All About Tax Brackets In Pakistan For 2019 Zameen Blog

Npa Alm Del 2018 19 1 Samling Bilag 3 Rapporter Og Resolutioner Fra Den Arlige Session I Halifax 2019

News Sme Finance Forum

Employment Taxation Kk Consultant Consultancy Firm Rawalpindi Islamabad Pakistan

Income Tax Rates In Pakistan 2020 21 Blog Filer Pk

Tax Rates For Businesses In Pakistan Download Table

What Was The State Of Healthcare In Pakistan Pre Covid 19

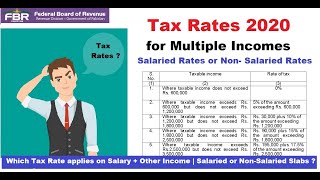

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non Salaried Fbr Ty 2020 Youtube