Payroll tax estimator 2023

Terms and conditions may vary and are subject to change without notice. Tax Return Access.

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

. If you make 40000 a year for instance the amount of tax you will pay depends on which filing status you qualify for. Advance payments of the premium tax credit of 4200 are made to the insurance company and Amy pays premiums of 4500. May not be combined with other offers.

Your decision to file single jointly or as head of. The cost of her health insurance premiums in 2021 is 8700. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

1 University Circle Macomb IL 61455 USA Phone. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. The payroll tax credit election must be made on or before the due date of the originally filed income tax return including.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. On her 2021 tax return Amy is allowed a premium tax credit of 3600 and must repay 600 excess advance credit payments which is less than the repayment limitation. See what tax forms are included in TurboTax Basic Deluxe Premier and Home Business tax software.

When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Use this FREE online calculator to quickly estimate your annual and quarterly federal personal income tax payments.

Before you choose to outsource any of your payroll and related tax duties that is withholding. Terms and conditions may vary and are subject to change without notice. The difference in tax rates are significant and can mean the difference between paying up to 10 percent or 35 percent.

From 1 January 2023 the deduction range will increase which means a reduction in payroll tax for small and medium businesses. Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is available through 12312023. For annual Australian taxable wages over the 13 million threshold the deduction will change to 1 for every 7 of taxable wages over this amount.

Employment verifications may be sent to the Payroll Office 878-4124. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Americas 1 tax preparation provider.

Tax Return Access. Your filing status can make a big difference in how much income tax you pay. We can also estimate your tax refund or amount you may owe the IRS.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Our deduction finder helps you discover over 350 tax deductions and credits to get you the biggest tax refund.

Tax Return Access. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. For tax years beginning after 2015 a qualified small business may elect to claim up to 250000 of its credit for increasing research activities as a payroll tax credit against the employer share of social security tax.

Terms and conditions may vary and are subject to change without notice. Terms and conditions may vary and are subject to change without notice. Time and Attendance System TAS for.

And access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Terms and conditions may vary and are subject to change without notice. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Included with all TurboTax Free. 309 298-1414 Text Telephone.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Offer period March 1 25 2018 at participating offices only. Tax Return Access.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. 1 online tax filing solution for self-employed. Terms and conditions may.

Terms and conditions may vary and are subject to change without notice. IRS Tax Withholding Estimator. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Tax Return Access. 1 online tax filing solution for self-employed. Terms and conditions may vary and are subject to change without notice.

Tax Return Access. Tax Return Access. You may also use the IRS Tax Withholding Estimator available at IRSgovW4app to estimate the.

The median property tax in California is 074 of a propertys assesed fair market value as property tax per year. Student Assistant Work Study Students Time and Attendance System. The above rates are separate.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Californias median income is 78973 per year so the median yearly. Changes from January 2023.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Terms and conditions may vary and are subject to change without notice. Terms and conditions may vary and are subject to change without notice.

California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. To meet the bona fide residence test you must reside in a foreign country or countries for an uninterrupted period that includes an entire tax year. TurboTax Deluxe Online tax software is the easy way to prepare your tax return and maximize tax deductions.

Uninterrupted period including entire tax year. Self-Employed defined as a return with a Schedule CC-EZ tax form. Americas 1 tax preparation provider.

Tax amount varies by county. 2023 to 80 2024 to 60 2025 to 40 and. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Tax Return Access. Terms and conditions may vary and are subject to change without notice. An entire tax year is from January 1 through December 31 for taxpayers who file their income tax returns on a calendar year basis.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

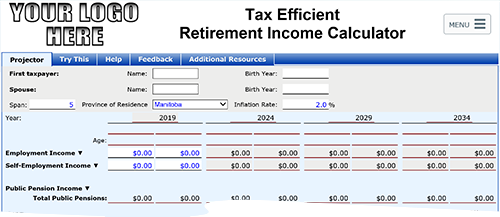

Knowledge Bureau World Class Financial Education

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

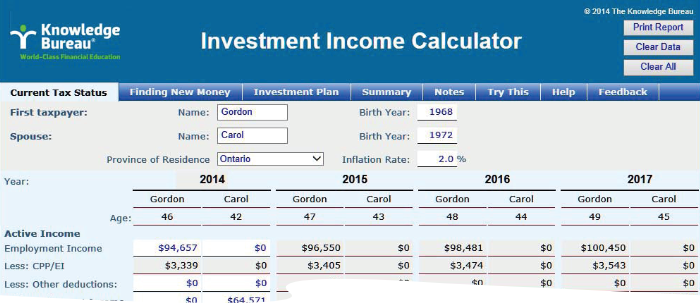

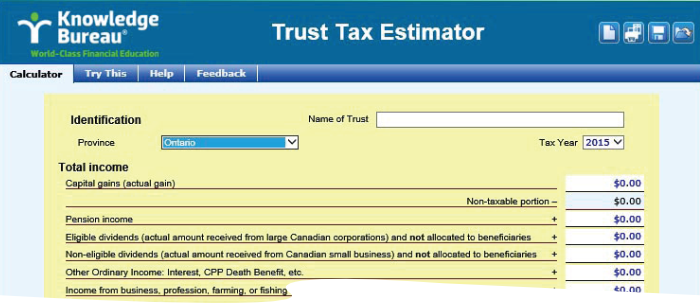

Knowledge Bureau World Class Financial Education

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

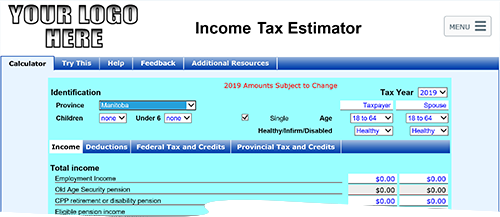

Simple Tax Calculator For 2022 Cloudtax

Knowledge Bureau World Class Financial Education

Knowledge Bureau World Class Financial Education

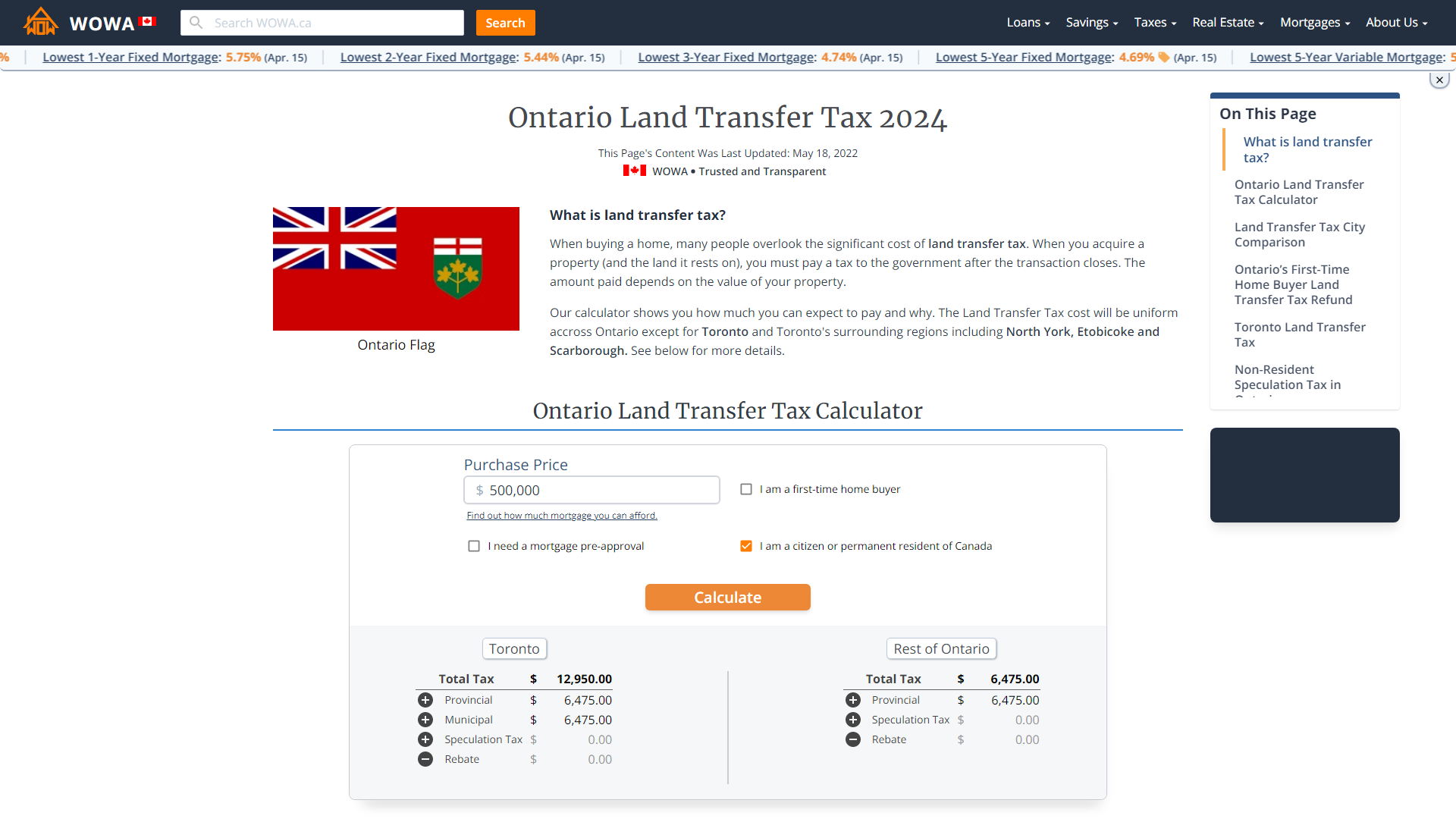

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

Health Insurance Tax Health Insurance Infographic Infographic Health Health Care Reform

Manitoba Income Tax Calculator Wowa Ca

Pin On Budget Templates Savings Trackers

2021 2022 Income Tax Calculator Canada Wowa Ca

H R Block Tax Calculator Services

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023